are funeral expenses tax deductible in 2020

If the IRS requires the decedents estate to file an estate tax return the estates representative may be able to include funeral expenses as. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

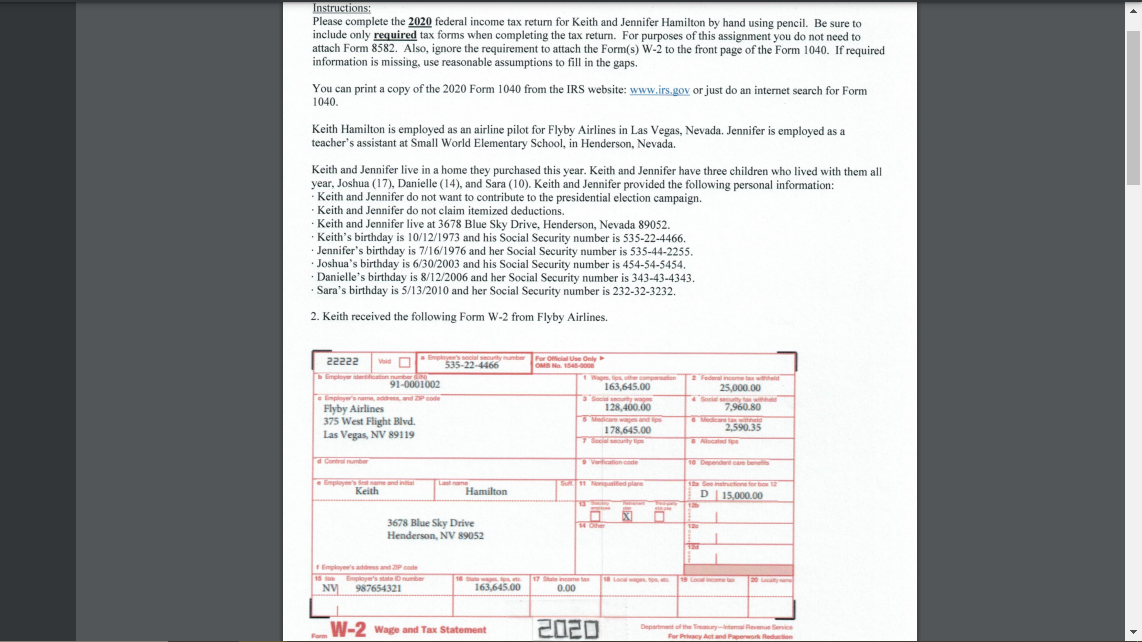

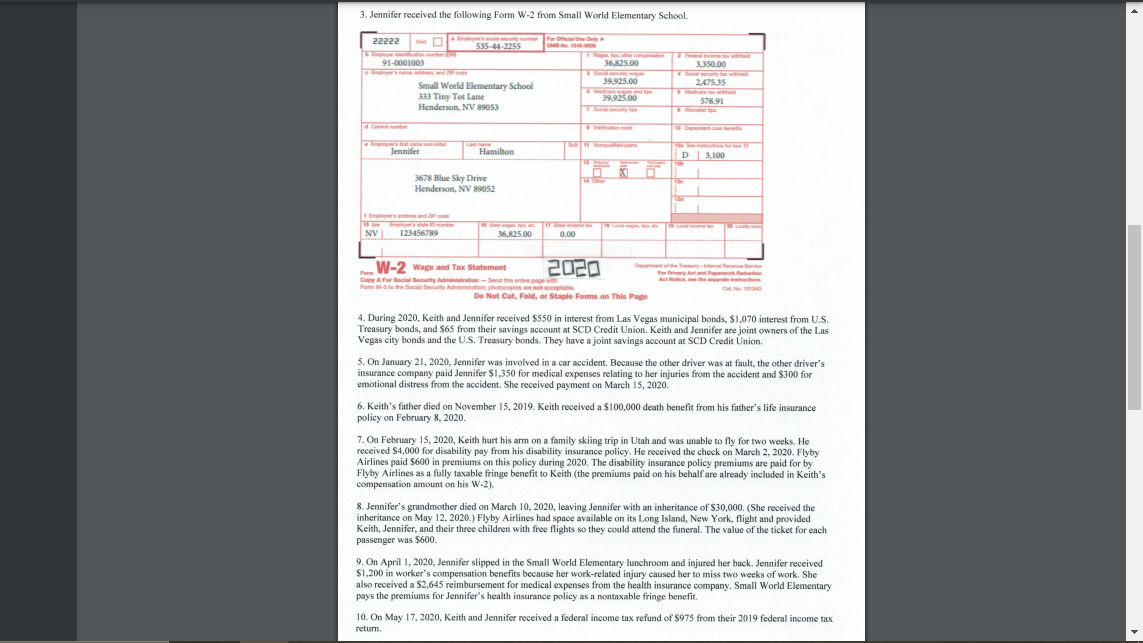

Instructions Please Complete The 2020 Federal Income Chegg Com

Can funeral expenses for my mother who was 96 years young and on Medicare and Medicaid such as pre-plan funeral costs and a monument be deducted on my 2020 taxes.

. The short answer is no. Placement of the cremains in a cremation urn or cremation burial plot. That depends on who received the death benefit.

In short these expenses are not eligible to be claimed on a 1040 tax form. If the beneficiary received the death benefit see line 13000 in the Federal Income Tax and Benefit Guide. Funeral expenses when paid by the decedents estate may be taken as a deduction on a decedents estate tax.

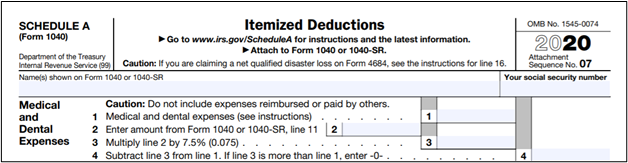

Burial or funeral expenses including the cost of the cemetery lot are not deductible as an itemized deduction on Schedule A Form 1040 Itemized Deductions. Qualified medical expenses include. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

The IRS deducts qualified medical expenses. IR-2020-217 September 21 2020. Deductible medical expenses may include but are not limited to the following.

In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. This means that you cannot deduct the cost of a funeral from your individual tax returns.

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body. The Tax Cuts and Jobs Acts TCJA prohibits individuals estates and. The taxes are not deductible as an individual only as an estate.

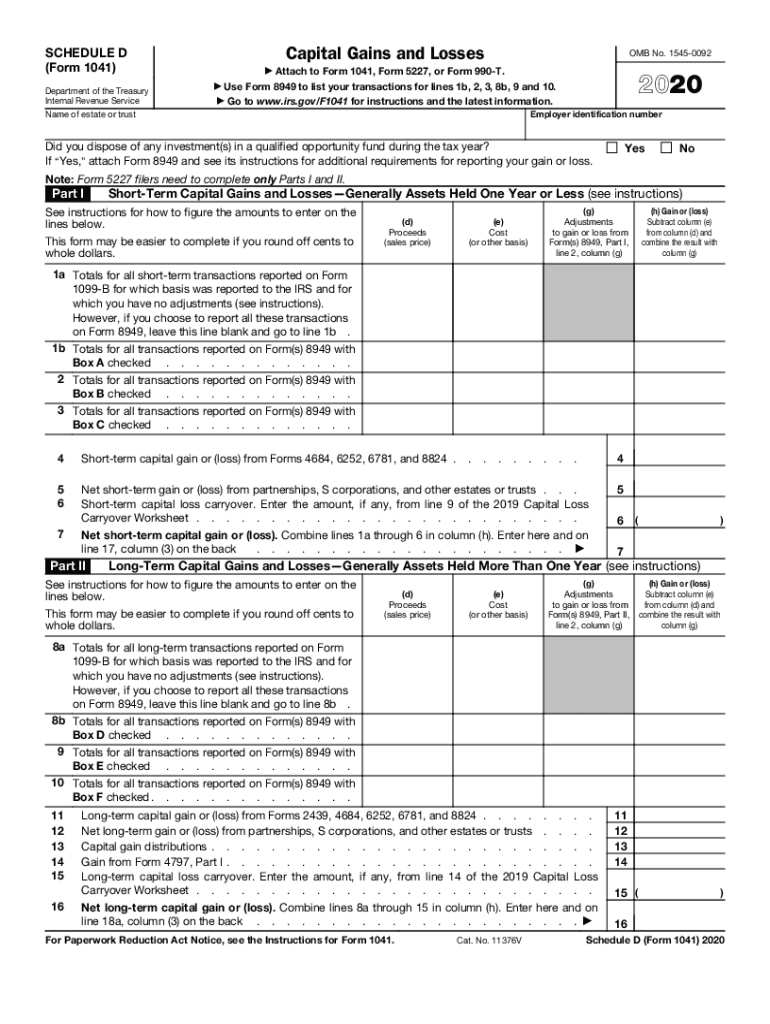

While the IRS allows deductions for medical expenses funeral costs are not included. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. Irs 1041 Schedule D 2020 2022 Fill Out Tax Template Online Us Legal Forms.

No never can funeral expenses be claimed on taxes as a deduction. Qualified medical expenses must be used to prevent or treat a medical illness or condition. This includes parents grandparents siblings and spouses.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable.

IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one. What funeral expenses are tax deductible. WASHINGTON The Internal Revenue Service today issued final regulations that provide guidance for decedents estates and non-grantor trusts clarifying that certain deductions of such estates and non-grantor trusts are not miscellaneous itemized deductions.

Funeral and burial expenses can be deducted if they were paid out by the estate of the deceased person. Are funeral expenses tax deductible in 2020. I paid about 14000 for.

The 300 of expenses incurred in 2021 can be deducted on the final income tax return. But for estates valued above 114 million in 2019 or 1158 million in 2020 deducting funeral expenses on the estates Form 706 tax return would result in a tax saving. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses.

The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit. Any family members out-of-pocket expenses for your. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses.

The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Individual taxpayers cannot deduct funeral expenses on their tax return. You may not take funeral expenses as a deduction on a personal income tax return.

While individuals cannot deduct funeral expenses eligible estates may be able to. To claim funeral expenses on your tax return the deceased must be a relative or an ancestor. Funeral expenses paid by your estate including cremation may be tax-deductible.

Funeral expenses are not tax deductible because they are not qualified medical expenses. If your family does not know your plan to pay for the funeral expenses from your estate your estate will not get any tax deductions. For a complete list of nondeductible expenses please refer to IRS Publication 529 Miscellaneous Deductions.

If you are not related to the deceased you cannot deduct their. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. A death benefit is income of either the estate or the beneficiary who receives it.

Are Funeral Expenses Tax Deductible It Depends

Are Funeral Expenses Tax Deductible It Depends

Utilize Tax Free Covid 19 Reimbursements For You And Your Staff Dental Economics

Are Funeral Expenses Tax Deductible It Depends

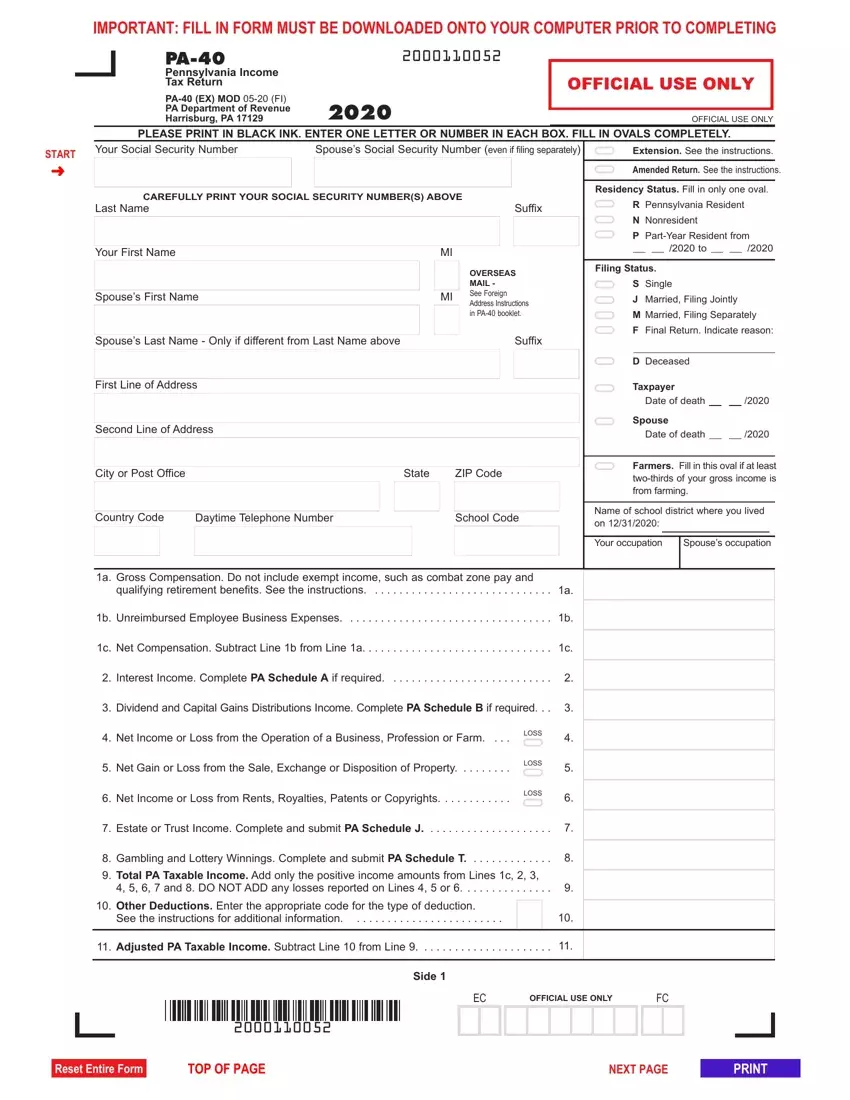

Pa 40 Tax Form Fill Out Printable Pdf Forms Online

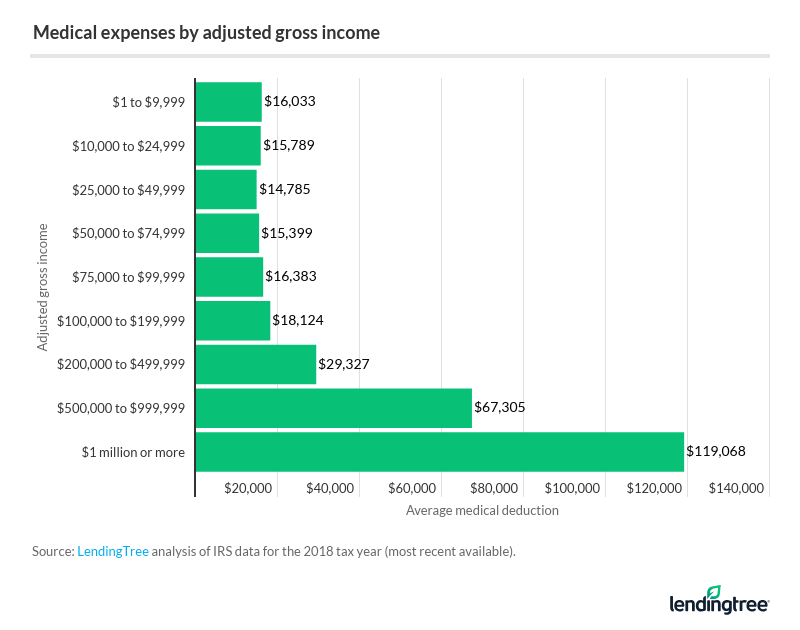

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

Employers May Make Tax Deductible Payments To Employees For Covid 19 Expenses Totem

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Amber Wedding Seating Chart Template Printable Seating Etsy Seating Chart Wedding Template Seating Chart Wedding Wedding Posters

Are Funeral Expenses Tax Deductible It Depends

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

Instructions Please Complete The 2020 Federal Income Chegg Com

Are Funeral Expenses Tax Deductible It Depends

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

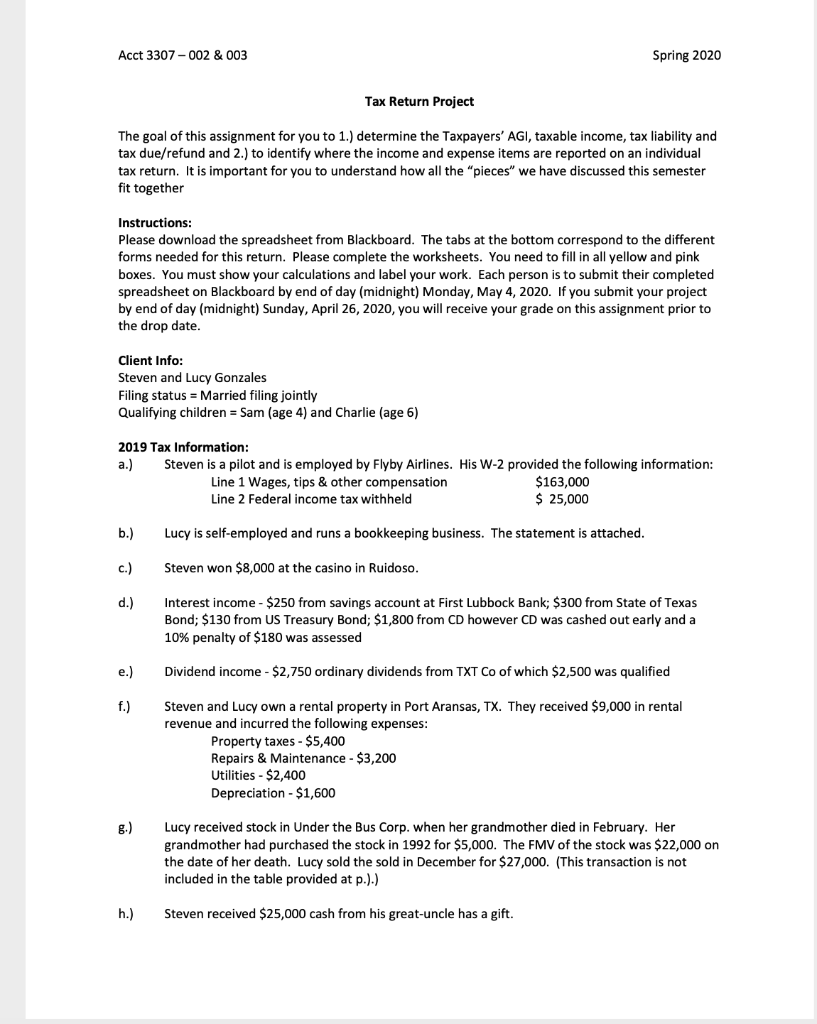

Acct 3307 002 003 Spring 2020 Tax Return Project Chegg Com

Irs 1041 Schedule D 2020 2022 Fill Out Tax Template Online Us Legal Forms